New Black Book poll of 118 health plan IT professionals finds data sharing success now depends on provider engagement and EHR vendor alignment.

CHICAGO, IL / ACCESS Newswire / October 23, 2025 / A Black Book Research flash survey of 118 payer IT leaders representing 45 health plans across 39 states reveals that while FHIR-based payer-provider data exchange is entering production across Medicare Advantage and other lines of business, a significant readiness gap remains among provider organizations as of Q4 2025.

Key Findings

Go-live status: 27% of health plans are live on one or more FHIR workflows (member attribution, coverage, care gaps, prior authorization). 38% plan to go live within 12 months; 35% have no defined timeline.

Medicare Advantage vs. Commercial: 64% report Medicare Advantage contracts are leading FHIR adoption, while 58% say commercial lines are trailing by a year or more.

Automation outlook: Median expectations show 30% of prior authorizations will be API-automated by 2026, aligning with CMS interoperability and prior authorization deadlines.

Biggest blockers: 77% cite contracting and data-use agreements, 50% data mapping/normalization, 40% testing capacity, 39% vendor bandwidth, and 34% unclear ROI.

Clinician impact: 44% expect reduced clinician burden through automated data exchange; 39% remain uncertain pending EHR integration maturity.

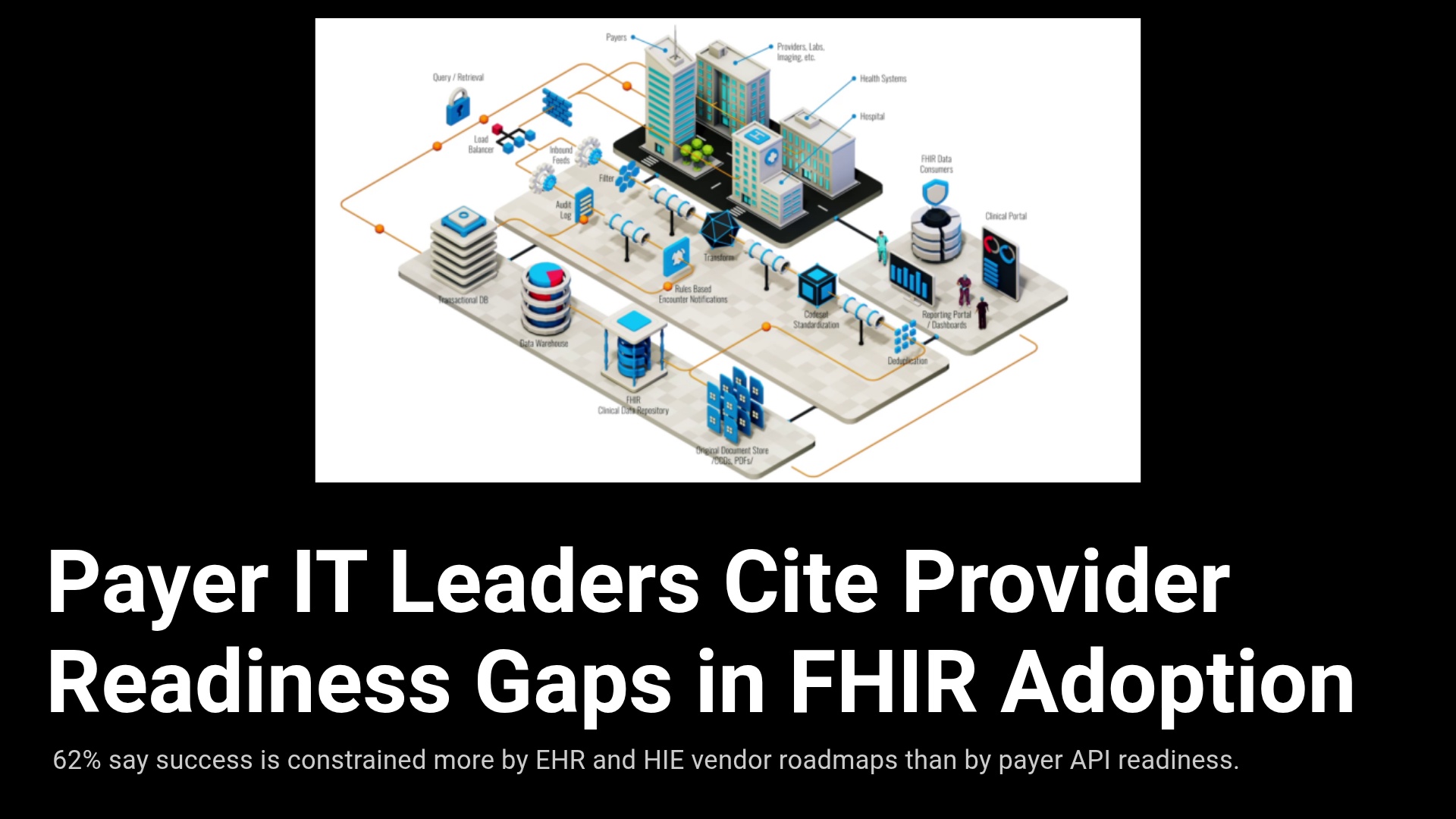

Vendor dependency: 62% say success is more constrained by EHR and HIE vendor roadmaps than payer API readiness.

Provider Readiness Remains Uneven

Payers report that only about one-third of provider organizations have initiated FHIR endpoint testing or implementation for payer exchange. Forty-one percent of providers have not yet engaged EHR vendors or clearinghouses, and just 17% have funded internal projects or governance structures to support payer-facing FHIR workflows.

Respondents identified three primary readiness gaps among provider organizations:

-

Testing limitations for connecting to payer APIs within existing EHR environments.

-

Insufficient FY26 budgeting for integration, data quality, and endpoint security.

-

Incomplete operational planning to embed payer data into clinical workflows.

Survey participants emphasized that sustained provider collaboration is now the determining factor for achieving production-scale FHIR interoperability. Immediate readiness actions identified by payer IT leaders include:

-

Confirming FHIR support and sandbox access with EHR and clearinghouse vendors.

-

Forming cross-functional implementation teams across IT, HIM, and clinical operations.

-

Establishing testing schedules and cutover plans for initial workflows such as Medicare Advantage attribution and prior authorization.

-

Budgeting in FY26 for conformance testing, data mapping, and endpoint security.

Providers without full EHR-native FHIR capability can pursue interim options such as middleware integration platforms, regional HIE participation, or “FHIR-as-a-Service” adapters to connect with payer APIs. These approaches allow near-term compliance and workflow readiness ahead of the 2026 CMS interoperability milestones.

“FHIR at scale is no longer theoretical,” said Doug Brown, Founder of Black Book Research. “Our polling data shows payers are technically prepared, but overall progress now depends on provider execution and EHR vendor enablement. The next twelve months will determine whether FHIR interoperability becomes standard infrastructure or remains fragmented. Alignment on testing, onboarding, and governance will decide how quickly payers and providers can deliver the expected benefits: automated prior authorizations, real-time coverage validation, and actionable care-gap data.”

The Providence-Humana rollout of a scalable FHIR exchange earlier this quarter demonstrates operational feasibility, but most payers in this study cited provider-side integration as the principal bottleneck. Without timely investments in onboarding and conformance, the anticipated improvements in administrative efficiency and data liquidity will be delayed, which prompted several payer industry requests for this poll. Margin of error: ±9% at 95% confidence.

About Black Book Research

Black Book Research LLC is an independent research and polling firm serving the healthcare and life sciences industries. Since 2009, Black Book has surveyed millions of healthcare professionals to benchmark technology adoption, user experience, and vendor performance across providers, payers, and public health organizations. Industry stakeholders can access complimentary reports at www.blackbookmarketresearch.com or contact research@blackbookmarketresearch.com for additional information.

Contact Information

Press Office

research@blackbookmarketresearch.com

8008637590

SOURCE: Black Book Research

View the original press release on ACCESS Newswire