TORONTO, ON / ACCESS Newswire / January 26, 2026 / Sun Valley Minerals Inc. (“Sun Valley“or the “Company“) is pleased to provide an update on recent activities and results at the Company’s wholly owned Tarumán Gold-Silver Project in Uruguay, as well as plans for 2026:

-

Significant intercepts from an ongoing trenching program at Tarumán Main include:

-

TR34: 80.55m @ 2.67 g/t Au; including 42.35m @ 4.25 g/t Au (ended in mineralization)

-

TR33: 91.35m @ 1.24 g/t Au;including 37.00m @ 1.78 g/t Au (ended in mineralization)

-

TR35*: 41.60m @ 2.46 g/t Au; including 26.05m @ 3.72 g/t Au (partial results)

-

TRDD02: 14.00m @ 12.22 g/t Au

-

TRDD05: 24.00m @ 3.16 g/t Au

-

-

VG identified in initial Tarumán Group regional stream sediment sample concentrates – Program ongoing

-

Applied for 3 new prospecting licences totalling ~40,015 hectares

-

Appointed Elaine Ellingham to the Board of Directors

-

Provide update on ongoing and planned activities

-

Provide Tarumán Project overview & updated geological understanding

Tarumán Main – Exploration Update

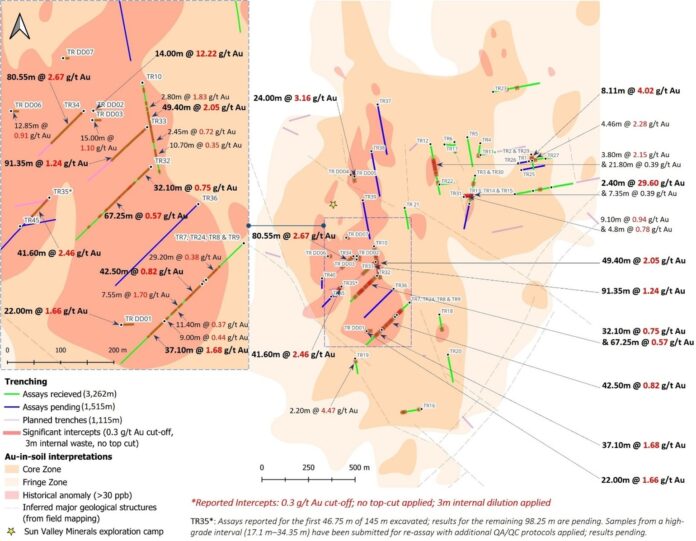

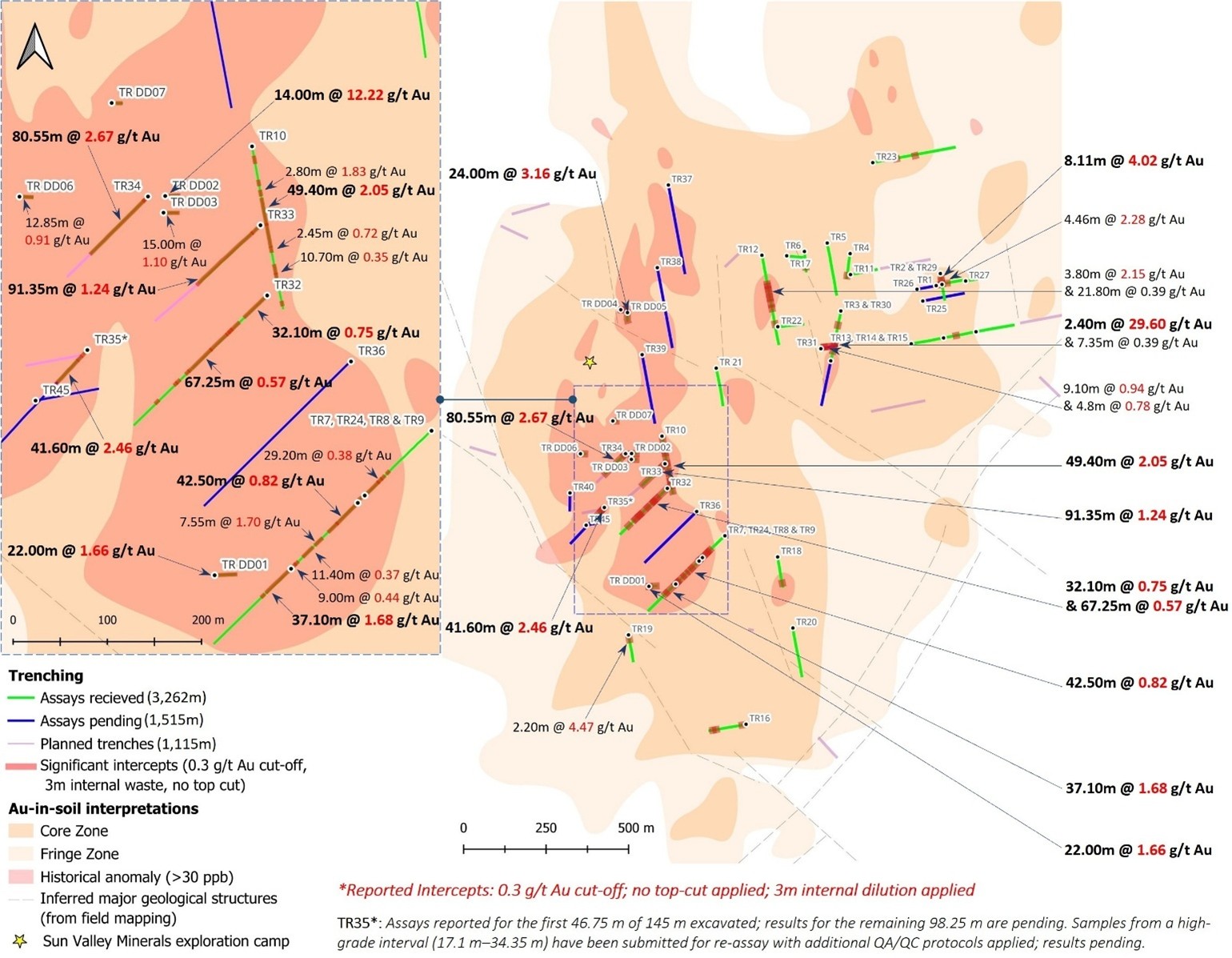

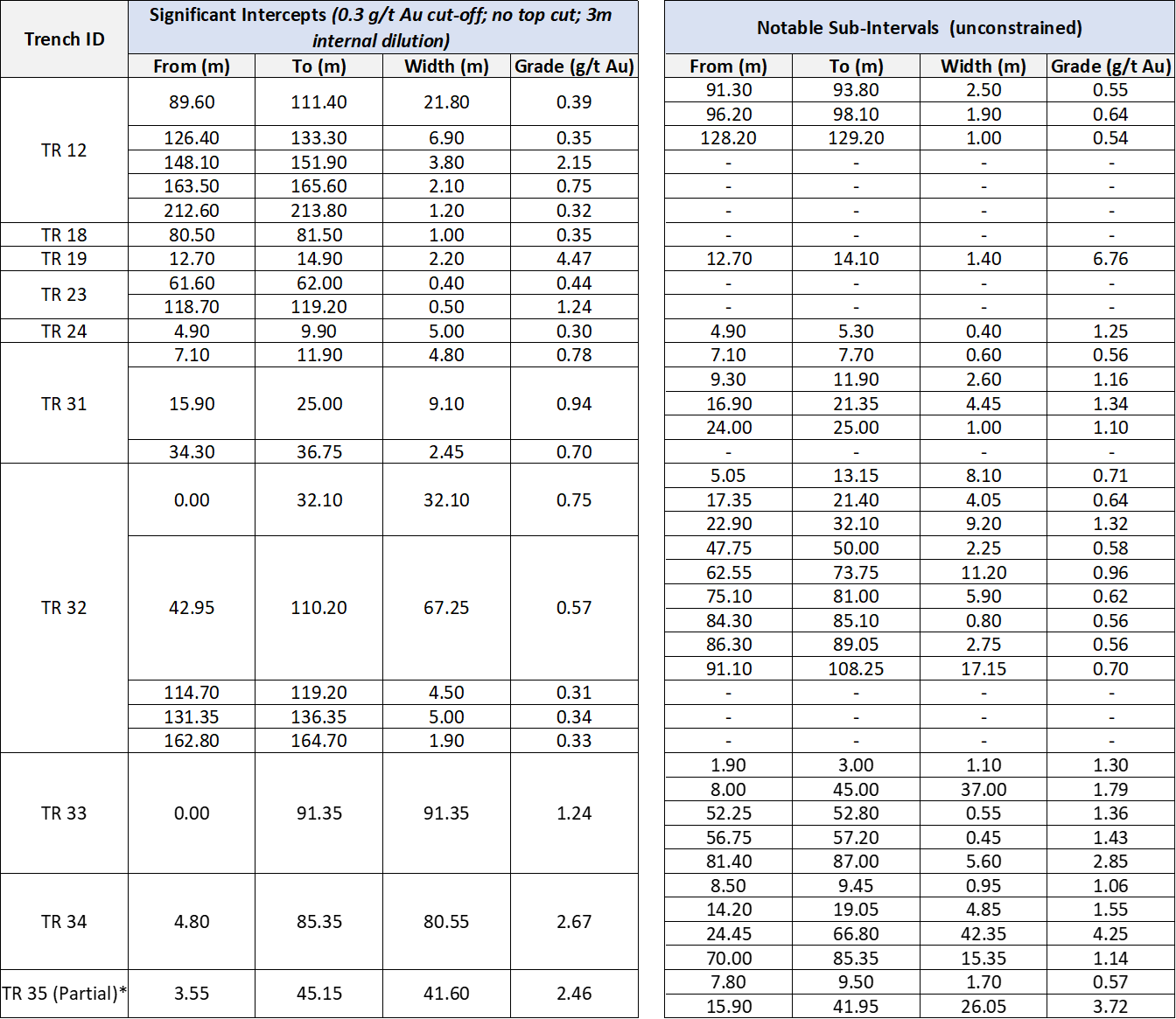

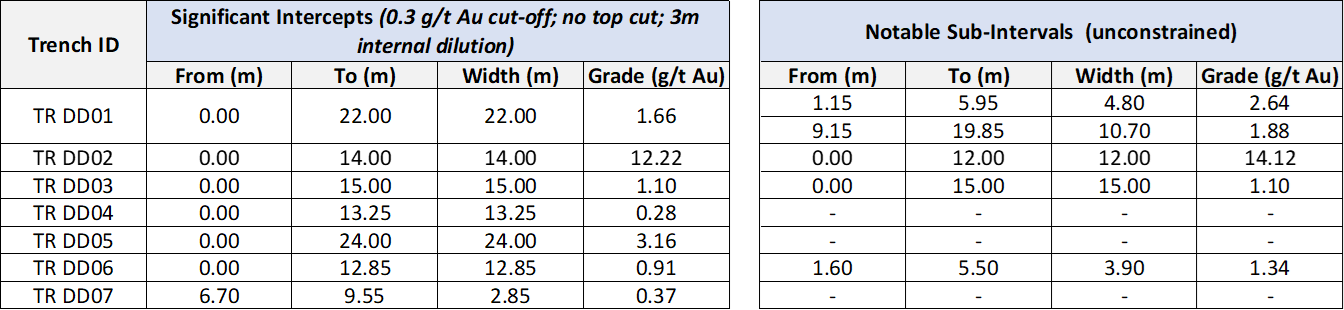

The Company completed approximately 4,800 metres of the planned 5,000-metre trenching program at Tarumán Main, with assay results received for 3,262 metres. Several notable gold-bearing intervals, including from due diligence trenches designed to verify historical trench results confirmed continuity of gold mineralization at surface along principal structural trends (Figure 1 & Tables 1, 2 & 3).

The anomalous to high-grade gold intercepts were primarily within the residual weathered regolith profile, with the highest gold tenors within a northeast-southwest trending carbonate-dominated assemblage crosscut by northwest-southeast to east-west trending quartz-sulphide veins and breccias. The regolith profile is suspected to have undergone a degree of supergene enrichment; however, the presence of primary sulphides at surface, particularly later-stage vein-and breccia-hosted sulphides, suggests a robust underlying system.

An initial drill program at Tarumán is anticipated in Q2. Induced Polarization (IP) and gravity surveys are currently underway to better define subsurface geometry and structural relationships and to assist in refining the upcoming drill program. These surveys will complement the Frequency Domain Electromagnetic (FDEM) survey completed in 2025, as well as recent results from the ongoing trenching program.

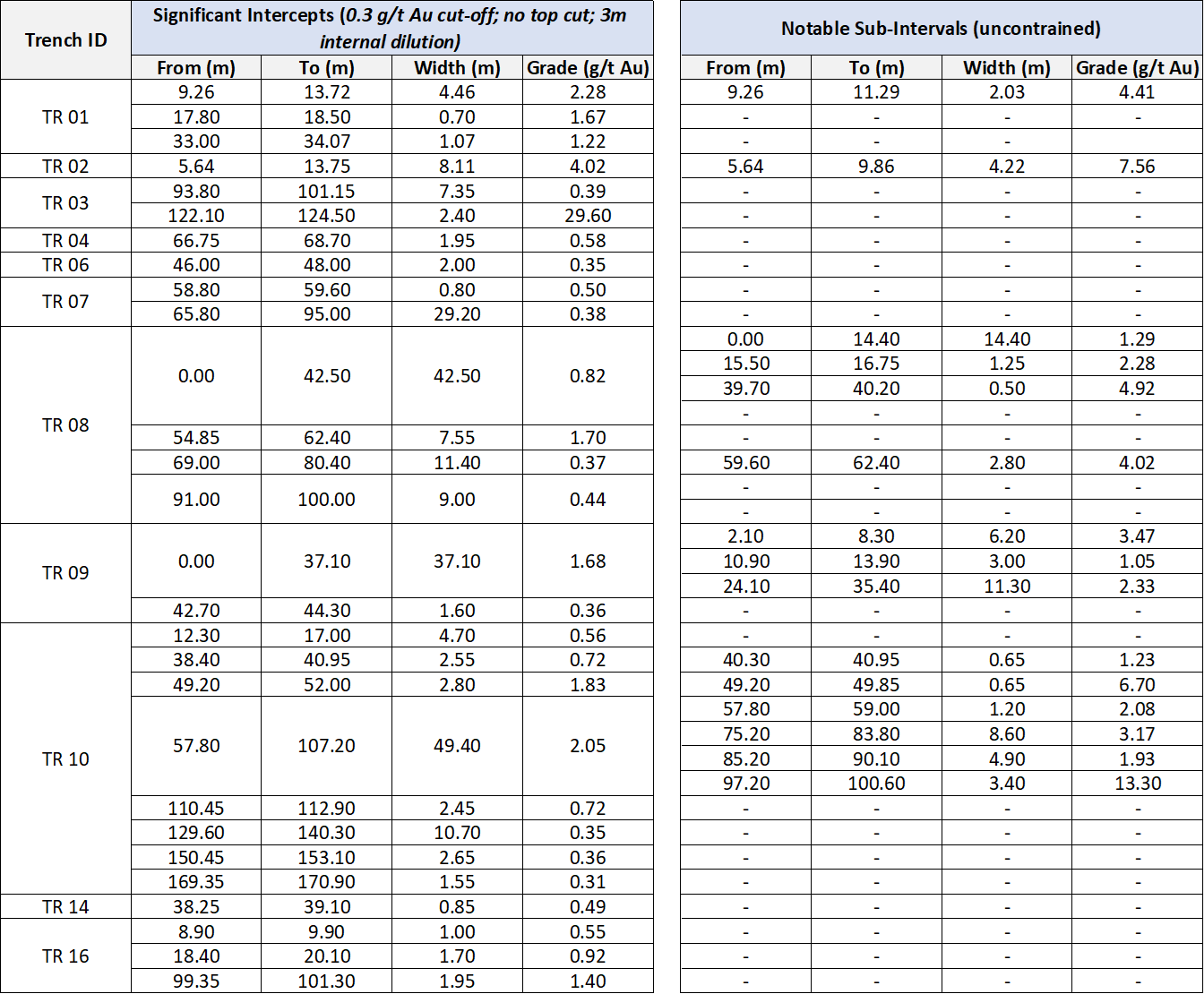

Table 1: Tarumán Main – Significant new trench intercepts (0.3 g/t Au cut-off, no top-cut, 3m internal dilution) & notable sub-intervals.

Table 2: Tarumán Main – Significant due diligence trench intercepts (0.3 g/t Au cut-off, no top-cut, 3m internal dilution) & notable sub-intervals.

Table 3: Tarumán Main – Significant trench intercepts previously reported on (0.3 g/t Au cut-off, no top-cut, 3m internal dilution)

Regional Exploration Update

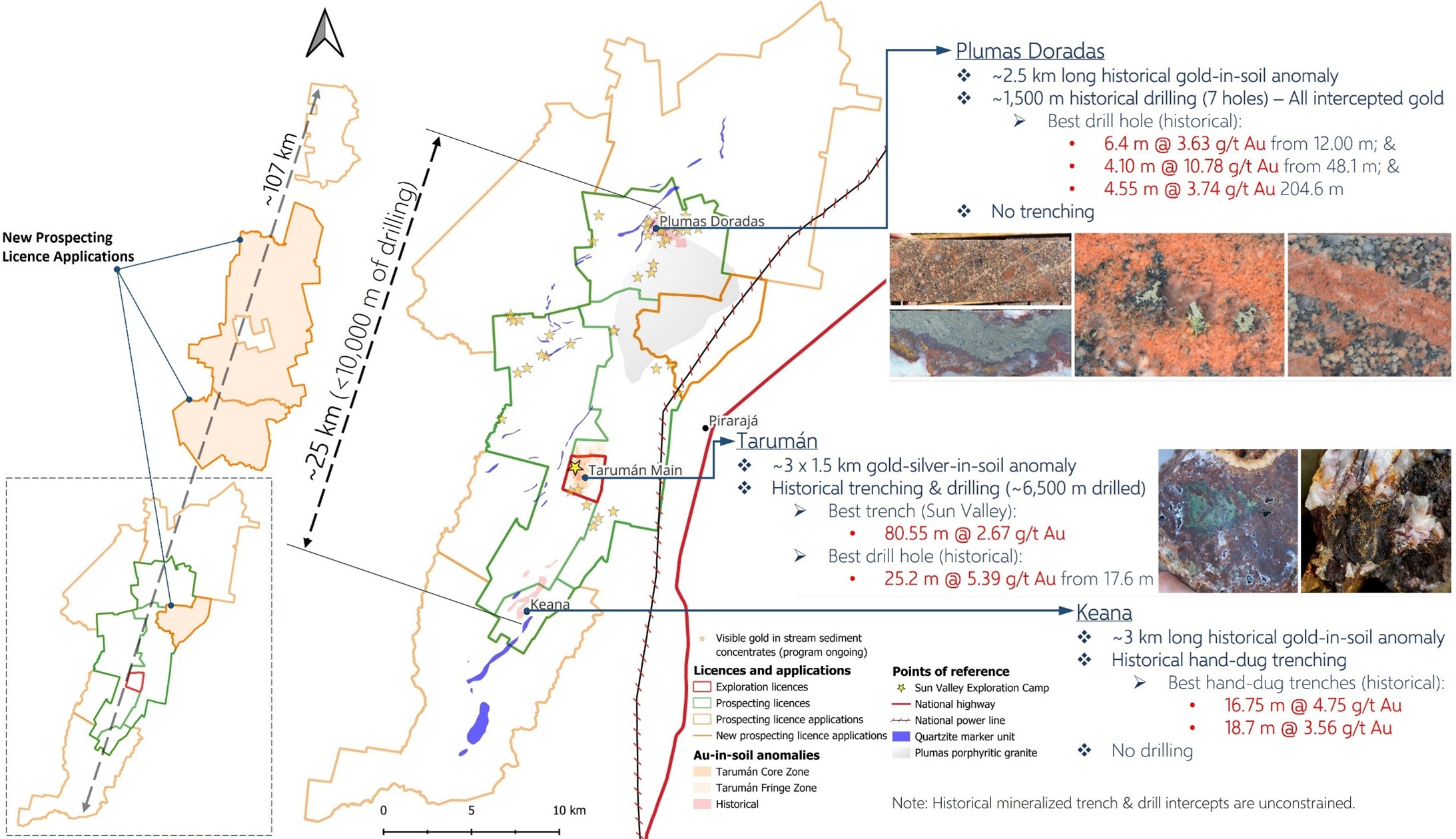

An ongoing regional stream sediment sampling program aimed at delineating mineralized trends and identifying new targets within the northeast-southwest trending Tarumán corridor has delivered promising early visual results. While laboratory assays remain pending, multiple Heavy Mineral Concentrate (HMC) samples have contained visible gold grains, providing immediate physical evidence of gold within catchments along strike of known prospects (Figure 2).

Mineral Licences & Licence Applications Update

The Company recently submitted three new prospecting licence applications totalling ~40,015 hectares. One of the applications is contiguous with the existing Tarumán group land package, whilst the remaining two aim to capture prospective ground along the northeast-southwest trending Dom Feliciano Fold-and-Thrust Belt (Figure 2). These new licence applications aim to increase the Company’s landholdings in Uruguay to ~143,744 hectares.

Appointment of Elaine Ellingham to the Board of Directors

The Company is pleased to welcome Elaine Ellingham to its Board of Directors. Ms. Ellingham is a highly accomplished mining executive with over 30 years of experience in mineral exploration and the mining industry, having held numerous senior corporate and leadership roles throughout her career. She currently serves as Chairman, President and Chief Executive Officer of Omai Gold Mines Inc. and is also a director of Alamos Gold. Ms. Ellingham has served as director of numerous junior mining companies, contributing extensive experience in corporate governance, capital markets, and strategic development. Notably, she spent eight years with the Toronto Stock Exchange in a variety of senior roles, including as National Leader of Mining. Ms. Ellingham holds a Master of Science and a Master of Business Administration from the University of Toronto and is a Professional Geoscientist.

General Activities Update

In-country preparations are underway to support a larger-scale exploration program, to include systematic soil sampling and multi-rig drilling campaigns. As part of this capacity-building initiative, several properties have been secured in the town of Pirarajá to serve as a central operational base. This infrastructure development is intended to centralize regional activities and streamline logistical coordination.

To accelerate target generation and project follow-up, the Company has purchased a dedicated in-house analytical suite (including a PPB detect ORE kit and pXRF) and a proprietary small-diameter RC/AC drill rig. These assets, scheduled for setup and arrival in Uruguay by late February, will provide the Company with the capability to operate in a self-sufficient manner and to rapidly detect, follow up, and drill-test surface anomalies as they are defined.

Furthermore, these investments represent a commitment to the local community, as the establishment of a long-term operational hub fosters local employment and creates opportunities for regional service providers. By integrating its activities within Pirarajá, the Company aims to build a sustainable operational foundation that supports both the project’s long-term growth and positive social engagement within the region.

In parallel with active field programs, the Company continues to expand its regional footprint and project pipeline through strategic licence applications targeting high-priority geological domains, guided by comprehensive technical review and systematic evaluation of available historical data.

Tarumán – Overview & Updated Geological Understanding

Regional Setting and Structural Architecture

The Project is situated within a poly-deformed fold-and-thrust sequence characterizing the broader orogenic evolution of the northeast-southwest trending Dom Feliciano Belt. This regional architecture is defined by large-scale thrust stacks, major fault and shear systems, and prominent terrane boundaries. Locally, the confluence of structural doming and broad-scale fold-and-thrust geometries is interpreted as a structural setting favourable for the development of significant mineralizing centres. This framework is further influenced by the widespread emplacement of syn- to post-tectonic Neoproterozoic granitoids.

Project-Scale Controls and Mineralization Styles

The stratigraphic sequence transitions from a western meta-carbonate domain, which hosts the highest gold tenors identified to date, to an eastern argillaceous meta-siliciclastic domain. On a project scale, the meta-carbonate sequence is defined by a northeast-southwest trending antiformal dome, with major lithological boundaries interpreted as sheared contacts related to regional northeast-southwest shear development. Within this structural framework, gold distribution is governed by two distinct mineralization styles, both fundamentally associated with varying intensities of sulphidation, dolomitization, silicification, and complex sulphide assemblages:

-

Replacement-Style Mineralization: This style of mineralization is broadly hosted within meta-carbonates that have undergone varying degrees of sulphidation, dolomitization, and silicification. Mineralization is predominantly intrafolial, trending northeast-southwest in alignment with the primary fabric of the host rocks, and locally features visible gold within altered zones. Geologically, this style shows a strong spatial association with fold geometries and shear zones, and appears to develop where mineralizing fluids encountered lithologies providing an optimal combination of chemical reactivity and competency contrast. These mineralized intervals are frequently observed in proximity to calcareous phlogopite-sericite-bearing schists.

-

Vein and Breccia Style Mineralization: This style of mineralization represents a subsequent, later-stage event characterized by quartz-sulphide assemblages and localized visible gold, primarily hosted within steeply dipping northwest-southeast to east-west trending vein structures. These typically define high-grade zones consisting of en-echelon and sheeted quartz-hematite and quartz-sulphide veins, which manifest both concordant and discordant to the primary foliation. Mineralization is preferentially localized within highly competent units, including dolomitized or silicified meta-carbonates and quartzitic intervals, where competency contrasts promoted the brittle fracturing and structural permeability essential for focused fluid flow. The development of these mineralized veins and breccias, along with their kinematic framework is currently interpreted as a potential result of regional contraction and the reactivation of pre-existing structures within a dextral shear regime.

Mineralization at the project is interpreted as a polymetallic assemblage based on a combination of historical records and current field observations. The primary sulphide suite appears to be dominated by pyrite, with associated sphalerite, enargite, chalcocite, tennantite, chalcopyrite, and galena reported within mineralized zones. Additionally, trace magnetite and native copper have been noted in specific occurrences. A well-developed oxidation profile is evidenced by a secondary mineral suite that includes observed instances of brochantite, covellite, malachite, and scorodite, alongside various secondary iron oxides. Native gold and silver are variably present across both styles. Geochemical data to date confirms this polymetallic character. Across all sample media, gold is most strongly associated with copper and antimony, followed by lead, arsenic, silver, and zinc. Moderate associations are also present with molybdenum, tin, bismuth, and tungsten.

Interpretation

The structural orientations observed to date are consistent with the regional northeast-southwest fabric and the northwest-southeast to east-west structural corridors delineated by geophysical interpretations and field mapping. This alignment suggests a multi-phased structural framework that appears to have governed the localization and focusing of mineralizing fluids. While current trench intercepts are situated within the weathered regolith profile, where supergene processes influence grade distribution and values, the identification of primary sulphides at surface and within trenching profiles suggests proximity to an underlying source.

The observed mineralogical complexity and the multi-element geochemical signature, characterized by strong gold associations with copper, antimony, lead, and arsenic, support the interpretation of a polymetallic system. Furthermore, the moderate statistical associations with molybdenum, tin, bismuth, and tungsten are being closely evaluated, as this specific elemental suite may suggest a potential contribution from a magmatic-hydrothermal fluid source. Such a signature may be characteristic of hybrid mineral systems where structural controls intersect and tap deeper-seated magmatic influences.

Lithological control is interpreted as a primary driver of mineralization volume. The western meta-carbonate domain exhibits the highest gold tenors, likely due to the optimal combination of chemical reactivity and competency contrast provided by the silicified and dolomitized meta-carbonate units. These mineralized intervals are frequently bounded by calcareous phlogopite-sericite-bearing schists. Mineralization identified within the eastern sequence is similarly localized within dolomitized meta-carbonate or competent quarzitic intervals, though it is currently observed to be volumetrically less abundant. This variation is attributed to the reduced chemical reactivity and lower competency of the argillaceous siliciclastic-dominant host rocks, which may have limited the development of significant structural traps.

The integration of ongoing IP and gravity surveys is intended to further refine this model by mapping subsurface density contrasts and chargeability and resistivity anomalies. This approach provides a technical basis for testing the continuity and depth extent of these mineralized zones, and any potential deeper intrusive drivers, during the upcoming drilling campaign.

Qualified Person’s Statement

Mr. Laubser Pepler, M.Sc. is Vice President Exploration of Sun Valley and has reviewed and approved the scientific and technical information in this shareholder update. He is a registered Professional Natural Scientist with the South African Council for Natural Scientific Professions (Pr. Sci. Nat. No.125018) and a Qualified Person for the purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Refer to Appendix A for an overview of technical procedures and methodologies related to sample collection, preparation and processing, and geochemical analysis relevant to results disclosed and discussed in this document.

Refer to Appendix B for a summary of significant trench Intercepts (>1.0 g/t Au; 1.0m Internal Dilution) and internal high-grade over-limit sample distribution and gram meter values.

About Sun Valley Minerals Inc.

Sun Valley Minerals is a Canadian exploration company engaged in responsible, systematic early-stage gold exploration and project generation in Uruguay. The Company holds 100% of the Tarumán group of projects, hosting multiple visible surface gold occurrences across ~25 km of the highly prospective, underexplored Dom Feliciano Fold and Thrust Belt.

For any further details, please do not hesitate to contact me.

On Behalf of The Board of Directors & The Sun Valley Team

Christo Stemmet – President & CEO

cstemmet@sunvalleyminerals.com

+1 647 877 4805

Cautionary Statement Regarding Forward-Looking Information

This shareholder update has been issued as a matter of interest to investors and other followers of the Company. This shareholder update contains certain statements that constitute “forward-looking statements” and “forward-looking information” within the meaning of applicable securities laws (collectively, “forward-looking statements”). Forward-looking statements include, but are not limited to, statements about the future financial or operating performance of Sun Valley Minerals Inc., the anticipated mineralization of its properties, its planned exploration programs and operational activities, and the anticipated nature of the Company’s projects. Generally, forward-looking statements can be identified by terminology such as “plan”, “expect”, “believe”, “project”, “estimate”, “forecast”, “intend” and other similar terminology, or statements that certain actions, events or results “will”, “may” or “would” or “will be achieved”.

Forward-looking statements are based on the expectations and reasonable assumptions of the Company’s management team at the time such statements are made. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, level of productivity, performance or achievements to differ materially from those expressed or implied by such forward-looking statements, including, but not limited to, general business, economic, competitive factors, dependence on third parties, actual results of operations and other commodity industry risks. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking statements, other factors may cause results not to be as anticipated, estimated or intended.

The recipient agrees and acknowledges that neither Sun Valley nor any of its representatives has any obligation whatsoever to update or keep current any information contained herein at any time, and the Company hereby disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Investment in the common shares of the Company is highly speculative given its present stage of development.

All references to dollar amounts in this shareholder update are to Canadian dollars unless otherwise specified.

Appendix A

Technical Procedures and Methodologies

|

WORK STREAM |

SUMMARY PROCEDURES & METHODS |

|

Trenching |

Sample Collection and Analysis

Logging & Data Management

Laboratory & Analytical Methods

|

|

Stream |

Sample Collection and Logging

Laboratory & Analytical Methods

|

|

Intercepts |

Significant Intercept Calculation

|

Appendix B

Summary of Significant Trench Intercepts (>1.0 g/t Au; 1.0m Internal Dilution) and Internal High-Grade Over-Limit Sample Distribution and Gram Meter Values

|

No. |

Gram Meters |

Trench ID |

From (m) |

To (m) |

Width (m) |

Grade (g/t Au) |

Overlimit (>10 g/t Au) Sample Details |

|---|---|---|---|---|---|---|---|

|

1 |

169.44 |

TR DD02 |

0.00 |

12.00 |

12.00 |

14.12 |

1.05m @ 90.00 g/t Au (L8380; 5.0kg) from 0.00m |

|

1.00m @ 58.20 g/t Au (L8382; 5.0kg) from 2.10m |

|||||||

|

2 |

157.41 |

TR 34 |

32.00 |

63.80 |

31.80 |

4.95 |

0.65m @ 10.30 g/t Au (L8503; 6.0kg) from 36.45m |

|

0.80m @ 17.95 g/t Au (L8506; 6.1kg) from 37.60m |

|||||||

|

0.30m @ 70.50 g/t Au (L8536; 5.4kg) from 57.30m |

|||||||

|

0.45m @ 86.20 g/t Au (L8538; 5.1kg) from 57.60m |

|||||||

|

0.55m @ 13.20 g/t Au (L8539; 5.0kg) from 58.05m |

|||||||

|

3 |

78.80 |

TR 35* (Partial) |

17.10 |

27.05 |

9.95 |

7.92 |

1.80m @ 11.25 g/t Au (L9671; 6.2kg) from 17.10m |

|

1.80m @ 10.50 g/t Au (L9674; 6.4kg) from 21.60m |

|||||||

|

1.90m @ 13.75 g/t Au (L9681; 5.9kg) from 25.15m |

|||||||

|

4 |

71.04 |

TR 03 |

122.10 |

124.50 |

2.40 |

29.60 |

2.40m @ 29.60 g/t Au (L7191; 6.7kg) from 122.10m |

|

5 |

56.92 |

TR 33 |

13.65 |

40.25 |

26.60 |

2.14 |

– |

|

6 |

54.77 |

TR DD05 |

9.70 |

24.00 |

14.30 |

3.83 |

0.45m @ 12.05 g/t Au (L8370; 13.3kg) from 14.80m |

|

7 |

45.22 |

TR 10 |

97.20 |

100.60 |

3.40 |

13.30 |

0.90m @ 43.90 g/t Au (L7523; 5.9kg) from 97.20m |

|

8 |

31.08 |

TR02 |

5.64 |

8.42 |

2.78 |

11.18 |

1.76m @ 17.05 g/t Au (L7108; 15.4kg) from 5.64m |

|

9 |

27.26 |

TR 10 |

75.20 |

83.80 |

8.60 |

3.17 |

– |

|

10 |

26.33 |

TR 09 |

24.10 |

35.40 |

11.30 |

2.33 |

1.00m @ 11.65 g/t Au (L7590; 5.3kg) from 34.40m |

|

11 |

21.51 |

TR 09 |

2.10 |

8.30 |

6.20 |

3.47 |

0.50m @ 21.90 g/t Au (L7570; 8.4kg) from 4.40m |

|

12 |

20.38 |

TR DD05 |

0.00 |

8.25 |

8.25 |

2.47 |

0.40m @ 10.20 g/t Au (L8352; 7.0kg) from 4.25m |

|

13 |

20.12 |

TR DD01 |

9.15 |

19.85 |

10.70 |

1.88 |

– |

|

14 |

12.67 |

TR DD01 |

1.15 |

5.95 |

4.80 |

2.64 |

– |

|

15 |

12.19 |

TR 34 |

24.45 |

27.10 |

2.65 |

4.60 |

– |

|

16 |

11.26 |

TR 08 |

59.60 |

62.40 |

2.80 |

4.02 |

– |

|

17 |

10.93 |

TR 08 |

0.00 |

2.90 |

2.90 |

3.77 |

– |

|

18 |

10.74 |

TR 34 |

70.00 |

79.10 |

9.10 |

1.18 |

– |

|

19 |

9.46 |

TR 10 |

85.20 |

90.10 |

4.90 |

1.93 |

– |

|

20 |

9.46 |

TR 19 |

12.70 |

14.10 |

1.40 |

6.76 |

– |

|

21 |

8.95 |

TR01 |

9.26 |

11.29 |

2.03 |

4.41 |

– |

|

22 |

8.19 |

TR 35* (Partial) |

38.55 |

41.95 |

3.40 |

2.41 |

– |

|

23 |

8.17 |

TR 12 |

148.10 |

151.90 |

3.80 |

2.15 |

– |

|

24 |

7.90 |

TR 32 |

25.95 |

29.90 |

3.95 |

2.00 |

– |

|

25 |

7.52 |

TR 34 |

14.20 |

19.05 |

4.85 |

1.55 |

– |

|

26 |

7.33 |

TR 33 |

81.40 |

83.35 |

1.95 |

3.76 |

0.30m @ 11.85 g/t Au (L8829; 6.3kg) from 81.40m |

|

27 |

6.99 |

TR 33 |

85.15 |

87.00 |

1.85 |

3.78 |

– |

|

28 |

5.69 |

TR DD03 |

8.70 |

12.30 |

3.60 |

1.58 |

– |

|

29 |

5.23 |

TR DD06 |

1.60 |

5.50 |

3.90 |

1.34 |

– |

|

30 |

4.36 |

TR 10 |

49.20 |

49.85 |

0.65 |

6.70 |

– |

|

31 |

4.27 |

TR 34 |

28.45 |

29.25 |

0.80 |

5.34 |

0.35m @ 10.00 g/t Au (L8493; 5.6kg) from 28.45m |

|

32 |

4.16 |

TR 31 |

17.70 |

19.80 |

2.10 |

1.98 |

– |

|

33 |

3.92 |

TR 33 |

42.55 |

45.00 |

2.45 |

1.60 |

– |

|

34 |

3.36 |

TR 33 |

8.00 |

11.05 |

3.05 |

1.10 |

– |

|

35 |

3.15 |

TR 09 |

10.90 |

13.90 |

3.00 |

1.05 |

– |

|

36 |

2.99 |

TR 32 |

71.95 |

73.75 |

1.80 |

1.66 |

– |

|

37 |

2.85 |

TR 08 |

15.50 |

16.75 |

1.25 |

2.28 |

– |

|

38 |

2.73 |

TR 16 |

99.35 |

101.30 |

1.95 |

1.40 |

– |

|

39 |

2.72 |

TR 34 |

83.70 |

85.35 |

1.65 |

1.65 |

– |

|

40 |

2.50 |

TR 10 |

57.80 |

59.00 |

1.20 |

2.08 |

– |

|

41 |

2.46 |

TR 08 |

39.70 |

40.20 |

0.50 |

4.92 |

– |

|

42 |

2.32 |

TR 34 |

80.25 |

82.40 |

2.15 |

1.08 |

– |

|

43 |

2.14 |

TR 32 |

68.15 |

69.30 |

1.15 |

1.86 |

– |

|

44 |

2.11 |

TR DD03 |

4.30 |

5.80 |

1.50 |

1.41 |

– |

|

45 |

1.96 |

TR 35* (Partial) |

29.00 |

30.50 |

1.50 |

1.31 |

– |

|

46 |

1.88 |

TR 31 |

9.30 |

10.75 |

1.45 |

1.30 |

– |

|

47 |

1.43 |

TR 33 |

1.90 |

3.00 |

1.10 |

1.30 |

– |

|

48 |

1.38 |

TR DD03 |

0.00 |

1.30 |

1.30 |

1.06 |

– |

|

49 |

1.31 |

TR01 |

33 |

34.07 |

1.07 |

1.22 |

– |

|

50 |

1.31 |

TR 34 |

65.60 |

66.80 |

1.20 |

1.09 |

– |

|

51 |

1.31 |

TR DD03 |

14.00 |

15.00 |

1.00 |

1.31 |

– |

|

52 |

1.26 |

TR 32 |

97.10 |

97.90 |

0.80 |

1.58 |

– |

|

53 |

1.17 |

TR01 |

17.8 |

18.5 |

0.7 |

1.67 |

– |

|

54 |

1.10 |

TR 31 |

24.00 |

25.00 |

1.00 |

1.10 |

– |

|

55 |

1.01 |

TR 34 |

8.50 |

9.45 |

0.95 |

1.06 |

– |

|

56 |

0.80 |

TR 10 |

40.30 |

40.95 |

0.65 |

1.23 |

– |

|

57 |

0.75 |

TR 33 |

52.25 |

52.80 |

0.55 |

1.36 |

– |

|

58 |

0.64 |

TR 33 |

56.75 |

57.20 |

0.45 |

1.43 |

– |

|

59 |

0.62 |

TR 23 |

118.70 |

119.20 |

0.50 |

1.24 |

– |

|

60 |

0.58 |

TR 32 |

19.45 |

19.90 |

0.45 |

1.28 |

– |

|

61 |

0.51 |

TR 32 |

102.95 |

103.30 |

0.35 |

1.45 |

– |

|

62 |

0.50 |

TR 24 |

4.90 |

5.30 |

0.40 |

1.25 |

– |

SOURCE: Sun Valley Minerals Inc.

View the original press release on ACCESS Newswire